Creating a Comprehensive Asset Register for Your Business

In today’s fast-paced business environment, managing assets effectively is critical to operational success, financial reporting, and regulatory compliance. An asset register serves as a centralized record of all company assets—both tangible and intangible—allowing businesses to track, maintain, and optimize asset usage over time. This guide will walk you through how to create and maintain a comprehensive asset register for your business.

What is an Asset Register?

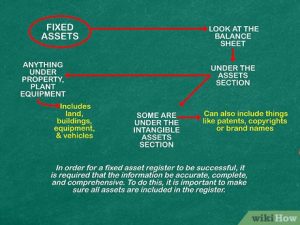

An asset register is a detailed log or database that records information about the assets owned by a business. It typically includes details such as asset type, location, purchase cost, purchase date, condition, depreciation value, and maintenance history.

Types of Assets Tracked

- Fixed Assets: Buildings, land, machinery, vehicles

- IT Assets: Computers, servers, software licenses

- Office Equipment: Furniture, printers, telephones

- Intangible Assets: Patents, trademarks, digital assets

Why an Asset Register is Important for Your Business

Maintaining a detailed asset register offers multiple benefits across different departments:

1. Accurate Financial Reporting

An asset register ensures correct representation of company assets on the balance sheet, helping with audits, insurance, and investor relations.

2. Improved Asset Utilization

Understanding what assets you have—and where they are—enables better allocation, reduces redundancy, and saves costs.

3. Maintenance & Lifecycle Management

Tracking the lifecycle and maintenance schedule of assets helps in reducing downtime and planning for timely replacements.

4. Compliance and Risk Management

Having a transparent and updated asset register helps meet regulatory requirements such as IFRS, GAAP, ISO 55000, or industry-specific compliance standards.

Steps to Creating a Comprehensive Asset Register

Creating an effective asset register isn’t just about listing your assets—it’s about implementing a sustainable process for managing them over time.

Step 1: Identify All Business Assets

Begin by auditing all current assets owned by the business. Include everything from IT hardware to intellectual property. Conduct physical inspections where necessary and collect data from accounting, procurement, and IT departments.

Step 2: Choose the Right Format or Tool

Decide how you will record and manage the register:

- Excel/Google Sheets: Suitable for small businesses with few assets

- Asset Management Software: Ideal for growing companies or those needing real-time updates, depreciation tracking, and integration with ERP systems

- CMMS (Computerized Maintenance Management Systems): For industries with heavy equipment and maintenance needs

Step 3: Define the Data Fields

Your asset register should include standardized fields to capture essential data:

- Asset ID/Tag Number

- Asset Description

- Category and Subcategory

- Location

- Assigned To (Owner/User)

- Purchase Date and Cost

- Depreciation Method and Value

- Maintenance Schedule

- Current Condition

- Disposal Date (if applicable)

Step 4: Tag Your Assets

Physical tagging of assets using barcodes, QR codes, or RFID tags makes it easier to track assets across locations and improve audit accuracy.

Step 5: Input and Verify Data

Enter all collected information into your chosen platform. Double-check for accuracy, especially in financial values and asset categories. This becomes the foundation for reports, audits, and forecasting.

Step 6: Set Up Access and Permissions

Limit access to ensure data integrity. For example, finance staff may need access to depreciation data, while IT may only need hardware tracking capabilities.

Step 7: Regularly Update the Register

Your asset register should be a living document. Schedule monthly or quarterly reviews to:

- Add new assets

- Remove disposed or obsolete items

- Update maintenance records

- Recalculate depreciation values

Best Practices for Managing an Asset Register

Use Automation Where Possible

Integrate asset management tools with procurement, accounting, and maintenance systems. Automating asset data capture reduces human error and administrative overhead.

Train Staff on Asset Policies

Ensure that employees understand how to record asset changes, transfers, or disposals. A standard operating procedure (SOP) helps keep the system clean and consistent.

Schedule Periodic Audits

Perform internal audits or physical verifications at least annually to confirm the presence and condition of critical assets.

Common Mistakes to Avoid

- Failing to update the register after asset disposal or relocation

- Not tracking intangible or leased assets

- Using inconsistent naming conventions or categories

- Ignoring asset lifecycle management or depreciation

Recommended Tools for Asset Register Management

Here are a few popular tools that can help streamline the creation and management of your asset register:

- Asset Panda – Customizable and mobile-friendly

- UpKeep – Good for maintenance-heavy industries

- Snipe-IT – Open-source and ideal for IT assets

- Zoho Creator – Build your own asset register workflows

Conclusion

Creating a comprehensive asset register is not just a compliance requirement—it’s a strategic advantage. It provides visibility into your company’s assets, improves decision-making, reduces costs, and ensures long-term operational efficiency. Whether you’re a startup or an established enterprise, investing the time and resources into building a reliable asset register will pay dividends in the long run.

Start small, stay consistent, and scale your system as your business grows. With the right tools and practices, your asset register will become a powerful asset in itself.